Investment Criteria

$10-50M

Target

Deal Size

8-10+%

Targeted Annual Cash Yield

13-15%

Targeted Net IRR to Investors

7-10

Average

Hold Time (yrs)

Strategy

Within the local submarket, we seek out assets that are located near large employment and retail centers, primary thoroughfares, public transportation access points, and/or quality school systems. By matching these criteria with our detailed multi-phase underwriting process, we are able to effectively manage portfolio downside risk from the start.

In summary, FMC focuses on multifamily investment opportunities where there is some level of fiscal or physical disconnect between the owner and/or manager and the asset. We specialize in identifying that disconnect and developing an appropriate repositioning strategy, which typically involves capital upgrades, utilizing more sophisticated property management, and implementing our institutional-grade asset management platform.

“There is no singular recipe for execution; we leverage our deep equity, debt, legal and risk-management relationships to create the optimal investment structure suitable for each asset.”

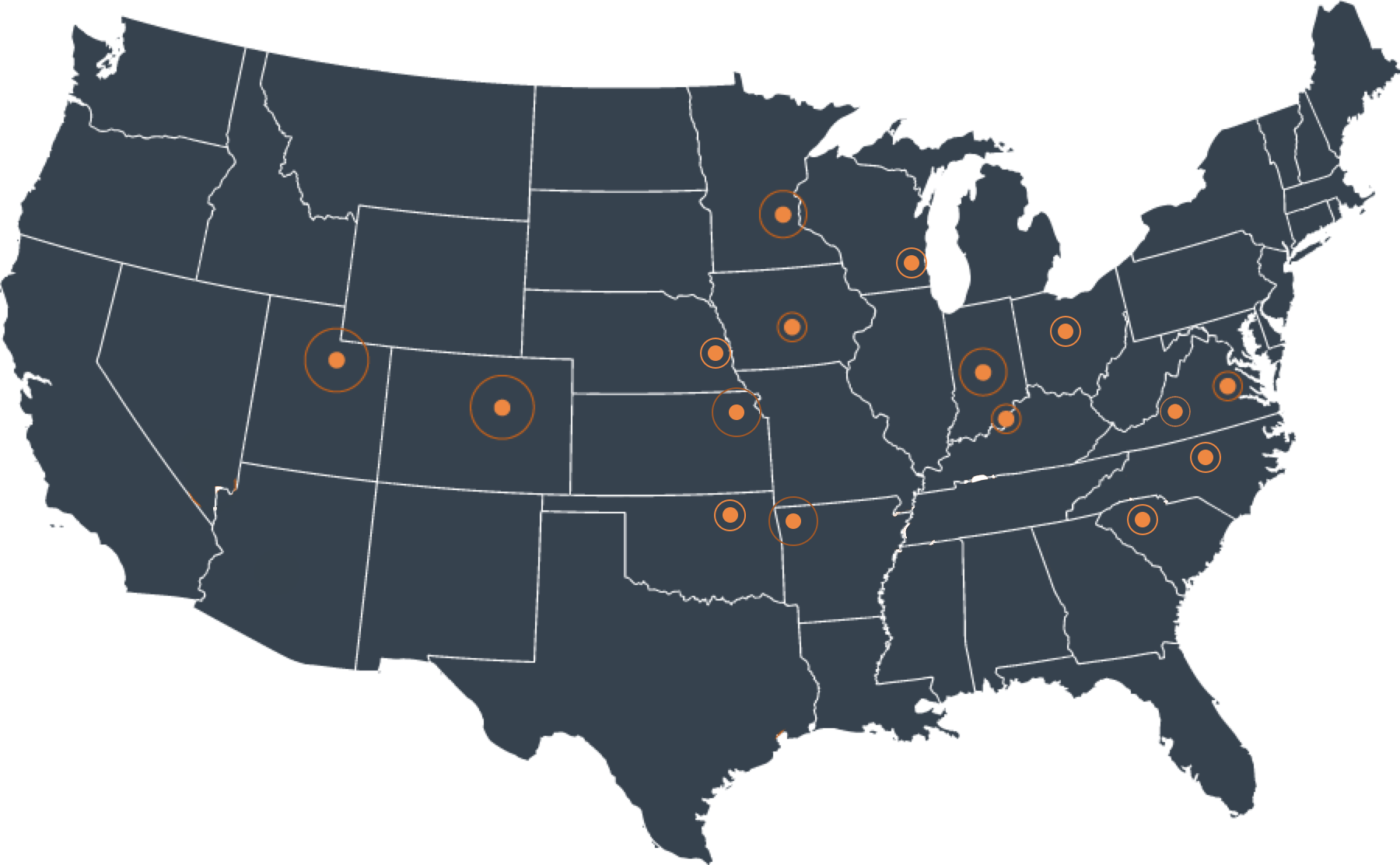

Target Markets